Global advisory, broking, and solutions company WTW has launched Asia’s first 4-peril parametric insurance to protect Sri Lanka’s shrimp farms against weather risks, marking a crucial turning point in Asia’s aquaculture development.

The unique solution was designed and placed for Taprobane Seafood Group, Sri Lanka’s largest seafood company, helping them meet a critical condition to secure USD 15 million in project financing from the Dutch entrepreneurial development bank FMO.

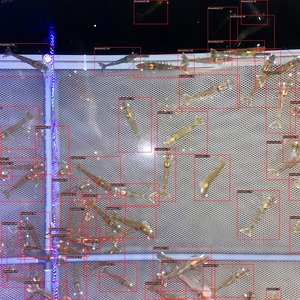

Shrimp farming is associated with a diverse range of risks and uncertainties, most prominently the exposure to weather risks across coastal regions where farms are traditionally located. To safeguard Taprobane against such vulnerabilities and unwind potential bottlenecks that constrain the injection of capital, WTW has structured the region’s first 4-peril parametric insurance solution that covers four key weather risks: earthquake, typhoon, excess rainfall and heat stress.

With the parametric insurance solution, Taprobane is able to secure the loan to develop sustainable shrimp farming and provide gainful employment to vulnerable communities locally, in turn enabling the growth of aquaculture in Asia and easing the ongoing food security concerns.

Marc Paasch, global head of Alternative Risk Transfer Solutions at WTW, said that “in the face of climate change, the growing susceptibility to natural catastrophes across many Asian markets could mean that food producers based in at-risk locations can suffer an adverse impact, affecting entire societies. This signifies an urgent need for innovative insurance and financing tools to better protect businesses. Our new 4-peril parametric insurance provides an efficient and simplified solution to support businesses vulnerable to multiple weather events that are not covered by traditional insurance products in the market.”

As Sri Lanka’s largest seafood business, Taprobane will use the funding from FMO to rehabilitate abandoned farms owned by the company and by third-party growers, as well as invest in new farms, circular tanks, hatcheries, and a new processing facility. This will also help support the employment of local employees that are made up predominantly of underprivileged women, including war widows, throughout the northern and northwestern provinces of the country.

In addition to financial support, FMO has provided technical assistance to help Taprobane achieve the Aquaculture Stewardship Council (ASC) certification, which recognizes companies for their responsible seafood farming practices.