Impact investor Bluefront Equity (Bluefront) makes its biggest investment ever when the seafood investor becomes majority shareholder of Cryogenetics, a supplier of services and technologies for reproduction of fish.

Cryogenetics is a provider of technology and services for the preservation of aquatic genes for the aquaculture industry and for safeguarding biological diversity. Bluefront’s strategy is to invest in businesses that contribute towards improved fish welfare and ocean health.

“One of the enablers for a more sustainable fish farming industry is access to fish that have genetics that make them as robust as possible at sea. Cryopreservation is an important support tool for breeding fish with the right characteristics. A sophisticated breeding process enables even better fish welfare and health. This is exactly what Cryogenetics helps the fish farming industry to achieve,” said Kjetil Haga, partner and CEO at Bluefront Equity.

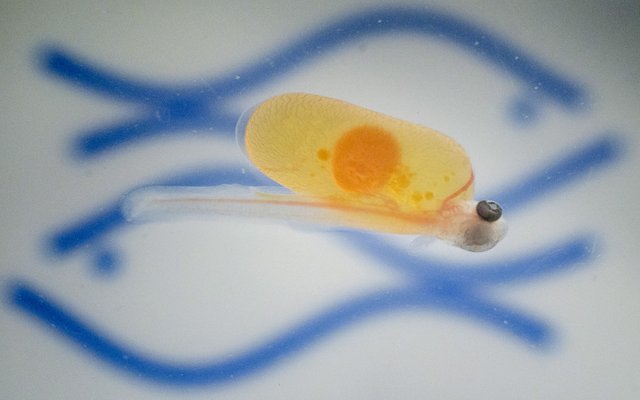

Cryogenetics is engaged in the process of freezing of fish milt for Norwegian and international fish egg producers, fish farming companies, and administrative bodies such as the US Department of Fishery and Oceans. The company contributes towards protecting the diversity of biological species by freezing genetic materials from vulnerable species such as wild Norwegian salmon on behalf of the Norwegian Environment Agency, or by storing back-up of valuable broodstock for food production.

The company was established in 2002 through research cooperation between the leading players in genetics and livestock breeding, including today’s largest shareholder – Geno – with its experience in the development and sale of frozen bovine semen. Cryogenetics has since developed technology and methods that support advanced fish breeding through cryopreservation of salmon milt and milt from other species. In short, these are methods of freezing and storing fish milt that can be utilized when the female fish is mature.

“Freezing of salmon milt allows us to combine different year classes, optimize genetics and secure optimal milt quality year-round. Further, cryopreservation enables the development of advanced product design for salmon egg producers and the ability to safeguard valuable genetics in case of loss of the broodstock. We have grown substantially in recent years and look forward to our next growth chapter with support from Bluefront,” said Eli Sætersmoen, managing director of Cryogenetics.

Growth ambitions

Cryogenetics operates globally. The company has established preservation laboratories in fish-farming nations such as Norway, Canada, USA and Chile. Cryogenetics’ headquarters is in Hamar, Norway, and the company has 18 employees.

Salmon farming is Cryogenetics’ largest market today. However, even in an industry that is under pressure to improve its biological results, only 20% of farmed fish derives from frozen milt. The corresponding figure for the livestock industry is more than 90%.

“We believe that advanced breeding is one of the keys to improved animal welfare, growth and profitability for the fish farming industry. Cryopreservation is an essential support tool for advanced breeding, and we, therefore, envisage significant growth opportunities going forward, not only within the salmon business but also within farming of trout,” Eli Sætersmoen added.

Cryogenetics and Bluefront’s growth strategy includes increased investments in Norway and internationally, both within salmon farming and other species such as halibut, trout, wolffish and cod.

Following the completion of all transactions related to the acquisition, Bluefront will own approximately 80% of the shares in Cryogenetics. Investinor and Eli Sætersmoen will own the remaining shares. Cryogenetics expects to deliver revenue of approximately NOK 55 million in 2024, which is equal to revenue growth of more than 20% compared to last year.