The start of 2023 could remain challenging for aquaculture farmers while coping with high input costs and what is likely to be a weaker demand. These issues directly affect hatcheries that need to adapt their production to demand and costs. Hatchery Feed & Management talked with some genetics and breeding companies to have a look at the year ahead and the role of genetics in the current context.

How is the rise in production costs impacting farmers?

Feed, labor and power are the main costs affecting farmers but it has not affected all farmers in the same way.

“During 2022, we have seen that inflation is impacting farmers differently depending on which market you look at. For example, Brazil and Vietnam were severely impacted because the rise in cost has been high and farmers were not able to pass the increased cost to buyers. This has caused an erosion of margins and a contraction of the overall demand for fingerlings and juveniles. In other markets such as the Philippines or Malaysia, the cost production pressure has been lower either because inflation has been somehow lower than in other countries or because farmers have been able to increase prices,” said Alejandro Tola Alvarez, CEO of GenoMar Genetics Group.

In the case of shrimp farmers, “the direct consequences are delayed harvest and not stocking with new PLs,” said Oscar Hennig, operations director of Benchmark Genetics Shrimp.

“The rise in production costs comes not only from inflation of feed and energy costs but also many times an increase in pond failure rates – failure rate defined as a crop failing to make expectation and resulting in a monetary loss. This is coming at the same time as an oversupply of shrimp in the world and decreases in consumer consumption resulting in some very low market prices,” said Robins McIntosh, executive vice president of Charoen Pokphand Foods Public Company.

As for the tilapia segment, “farmers are struggling with the increasing production cost, especially on feeds. This affects their investment capacity for growth and impels them to push efficiencies to the max. Farmers are trying alternate feed sources – some explore high-efficiency feeds, which are cost-efficient in the mid to long run, and some others could try and go for more rustic/basic and cheap solutions, which could affect their production results,” said Hideyoshi Segovia Uno, general manager at Spring Genetics.

David Danson, director of operations and shrimp, Hendrix Genetics, added that maintaining margins and generating a return on investments were also challenging. “There are only two ways to tackle this: increasing sales volumes and/or price, or reducing costs/increasing efficiency.”

Finally, a new issue has risen for Norwegian farmers. “The new tax system to be implemented in January 23 is also extremely high on the agenda as this will impact the operations and CAPEX going forward. Several projects are currently on hold,” Benchmark Genetics said.

How is the context affecting hatcheries?

In the case of shrimp, “the overall slow down on stocking of PLs by small and mid-sized farmers is directly affecting hatcheries now, but exporters and processors still need to cover their demands, so the industry maintains a significant momentum,” Hennig said. “Optimization of processes and cost efficiencies in production, good quality genetics and good decision-making is key for success in the current state of the industry.”

In tilapia, “smaller hatcheries might try to save money by using lower-cost/quality feeds or eliminating the use of additives, such as probiotics, or environmental solutions, etc. That’s why is important to acquire fingerlings from professional hatcheries. Benchmark has intensified its efforts on improving efficiencies without compromising quality,” Segovia Uno said.

Hatcheries' biggest dilemma is whether to produce or not given the uncertainty in markets, so farmers are not stocking or delaying stocking, Danson explained. He highlighted differences between species. “In salmon, and for large rainbow trout, hatcheries have continued to produce as products hatched today will lead to fillets in 1.5 to 2.5 years from now. Demand for pan-sized trout has remained stable, as this is a relatively affordable source of protein already. Shrimp has been most volatile, due to the combination of relatively short production cycles of 3-4 months and being a higher priced or more luxury product for the consumer,” Danson stated.

And how the hatcheries have been soaring in this context? “The mitigation measures at hatcheries have been price increases to mitigate rising costs, efficiency improvement and cost reduction measures, and if demand becomes too erratic or volatile, shut down production temporarily to avoid destruction of stocks. It’s a fight for survival in some sectors,” Danson stated.

In the case of salmon hatcheries, “both integrated and independent companies, have focused on high egg quality – size, hatching rates, low deformities and high survival – and for fry and smolt on high survival, low size variation, synchronized smoltification and fast growth,” Benchmark Genetics said.

“As costs come under pressure, the major determinants of cost – feed and efficiency – become increasingly important. So, traits that affect feed efficiency, biomass and yield receive more focus because these are closely related to the cost of production and value of the final product,” said Alan Tinch, vice president of Genetics at the Center for Aquaculture Technologies.

What have been the main challenges for genetics suppliers?

For GenoMar Genetics Group, “the biggest challenges have been to cope with a reduction in demand in certain markets and maintain our margins,” Tola Alvarez explained. “2022 has been a year, where due to contraction in demand, we have increased our focus on cost control and capacity utilization in our distribution business. Among other interventions, we have concentrated our production efforts in the most efficient sites and have improved the communication between market and production to properly plan inventory buildup. We have also negotiated more favorable prices and specifications with suppliers and, in general, we have looked at every possible way to reduce costs without affecting quality. This has represented a great opportunity to streamline our operations and believe we will harvest the benefits from it in the months and years to come.”

“Another mitigation measure has been the focus on selling prices and passing the real inflation in our cost to the market. It is important for the whole value chain that the hatchery business remains competitive,” Tola Alvarez mentioned. “When demand decreases, we obviously need to adjust our cost base to it so we can maintain a competitive price in the market.”

For Benchmark Genetics Group, “as we export broodstock worldwide, the biggest operational challenge is freight, due to high or increasing transport prices, and they are not as reliable/regular, as they were pre-pandemic,” said Hennig.

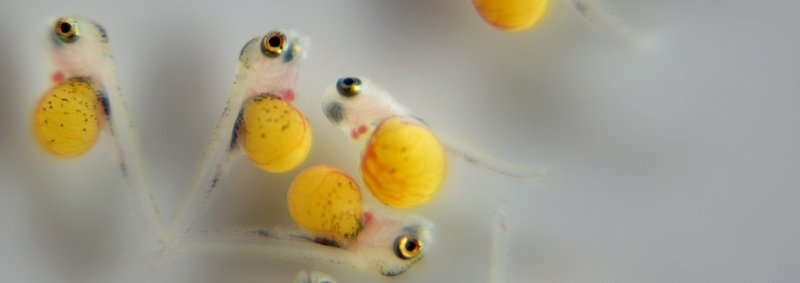

Credits: GenoMar Genetics Group

What to expect in 2023

High-cost levels are expected to stay, according to Segovia Uno. “In the case of exporters, the strong dollar is playing in their favor. We believe this situation might encourage producers to prioritize better-performing genetics to optimize their efficiencies.”

“Likely, we have tough times ahead in aquaculture, inflation will continue to dominate 2023 in all areas of the supply chain. As a breeding company, we believe farmers can give themselves the best opportunity to succeed by making sure they break with this downward spiral. This means getting stability in the supply chain (secure your partners, in feed, genetics, animal health and distribution), pushing innovation in the whole supply chain (disruptions like these also offer an opportunity for breakthrough), and specifically as a breeding company, making sure you cash on the generational improvement of your stocks,” Danson mentioned.

GenoMar Genetics Group expects that the inflationary pressure on production costs will stabilize during 2023 but sees other challenges. “The biggest challenge in the long term is access to labor. We think this will continue to deteriorate in years to come. Tilapia hatcheries are typically located in remote locations and are very labor-demanding and young people are less interested in working in the sector. We need to develop innovative strategies to attract and retain people,” Tola Alvarez stated.

A moderation in production is also expected in 2023, according to McIntosh, with countries not growing production and some countries having a production decline.

As for supply chains, suppliers such as Benchmark Genetics and GenoMar are optimistic and don’t see many issues here.

Hendrix Genetics has been working on a different strategy, to start producing in the countries in its key markets. This is not new for salmon, but for shrimp and trout, most of the seedstock is still imported. To prevent gaps in the supply chain, the company established multiplication programs in South Africa and Peru for trout and a new broodstock multiplication center in Bali in 2022 for shrimp. “This enables us to better serve our customers. Moreover, in 2023, we will be kicking off our brand new broodstock multiplication center in India and soon others will follow. This is more relevant than ever as, from a sales and shipping point of view, we continue to experience challenges with logistics,” Danson said.

“While AMI continues to build the USA broodstock distribution model, others have changed course, perhaps mostly out of necessity. Due to recent transportation challenges, it has been unrealistic to depend on remote islands to effectively distribute broodstock. We are aware of at least one competitor in this situation that has since expanded its footprint and established broodstock multiplication centers (BMCs) that are closer in proximity to their target markets,” said Robin Pearl, CEO of American Mariculture Inc. “Time will tell if this was a good or bad business decision, but it is a huge change, seemingly made out of convenience, that should not be overlooked and won’t come without its growing pains. Broodstock multiplication is very different from commercial post-larvae production. It takes a lot of experience and infrastructure to produce a crop for seed rather than for food and it can be a difficult learning curve that we should expect to impact farmers when it goes awry.”

“So many producers have become dependent on imported eggs, seed or fingerlings and COVID showed that this can be a very high-risk strategy. We’ve seen a sharp increase in the number of investors and CEOs who are now looking to gain more control over their production and reduce their risks by establishing their own broodstock. We’re also seeing governments looking to establish regional programs to enhance food security. There’s absolutely no sign of that trend slowing down,” said Chris Wallard, chief marketing and communications at Xelect.

How genetics can support hatcheries in this context?

“In the current situation, with a focus on the short-term cost of production, attention will focus on those traits most closely related to efficiency – growth and FCR. Growth is a major emphasis of most breeding programs, is easily measured and is highly correlated with feed efficiency. Other characteristics, such as edible yield and fat content, are increasingly considered as means of improving efficiency. All of these traits can be improved by using genomic selection, where genotyping is used to increase the accuracy of prediction in selecting broodstock. At the Center for Aquaculture Technologies (CAT), we have considerable experience in providing advice and support to hatcheries to enhance breeding for growth and efficiency,” Tinch said.

Genetic programs can also benefit when production costs are rising. “When your fish grow faster your overheads are reduced, or you can choose to sell a larger product at a higher price. But we think that’s just the start. Many forward-thinking farmers and feed producers are starting to recognize the potential of genetics to breed fish that are selected specifically to require less food or even fish that thrive on lower-cost feeds,” said Wallard.

Does the current situation leave room for genetic improvements?

In times of high inflation, investments are reduced and that may translate into a halt in new development projects, but suppliers said there is room for more improvements.

“Farmers are willing to pay a premium for our products because they realize our products are better and they expect them to be further improved in the future. We are collecting an increasing amount of performance data from the market, and we see clearly that more than 95% of the crops we follow result in profitability for the farmer 20-30%,” Tola Alvarez said. “The key to our business is to constantly invest in our breeding programs to improve the competitive performance of our products over time. We are investing in development projects that have the potential to deliver substantial efficiency gains in the tilapia value chain such as new methods for carcass analysis and projects that will result in more robust and resilient genotypes.”

“Genetics is a cost-effective way of delivering permanent improvement in performance over a number of traits. Pressure on costs will, however, reinforce the need to maximize selection pressure on traits most closely associated with efficiency. New methods of improving cost efficiency by bringing in novel traits, such as edible yield and fat content, should be considered as well as using genomic selection to breed for these characteristics. At CAT, we recognize that the next step in genetics is the use of genome editing to improve performance,” Tinch explained.

As for shrimp, “there is enough genetic variability in Benchmark Genetics’ vannamei stocks to spin lines for the new challenges the industry faces. We might experience a short halt, as liquidity could suffer during an adaptation period, but I believe it will soon regain its dynamism with the surge of new projects. The demand is still high,” Hennig said.

“Shrimp breeding is not keeping pace with salmon and tilapia, which are still far behind most domesticated species in terms of breeding investment. There is still plenty of time and space for someone to come out of nowhere, and make an unforgettable impact by simply dabbling in breeding strategies that are proven in other farmed species,” Pearl said.

“We're seeing a big increase in the number of companies investing in genetic R&D projects. Xelect is involved in numerous research activities into areas such as more robust, disease-resistant fish and shellfish. We’re also continuing our R&D into decreasing feed conversion ratios. We know for certain that the disruption of the last two years has caused some smaller producers to pause development activity, but more resilient farmers see this as an opportunity to accelerate and pull away from competitors who are standing still. When you’re talking about genetics that can be a pretty big deal. Even assuming a modest growth improvement of 10% per generation it’s easy to see how quickly you could get left behind,” Wallard concluded.