According to reports, the aquaculture industry, particularly the seabass and seabream sectors, faced significant challenges in 2023 with low demand and prices.

“Market prices, overproduction issues and sustainability of some large companies have been some of the main challenges in 2023. On technical aspects, deformities, output per tank, short-term and long-term growth rates, and other KPIs related to costs, as well as access to CAPEX for improvements on the operations, have also been the main concerns for hatcheries,” said Antonio Coli, global sales director at Planktonic.

In an inflationary period with rising costs, farmers have been applying different mitigation measures in 2023 to cope with this situation. “The diversification of product offerings can help mitigate risks associated with market fluctuations. Additionally, optimizing production efficiency and reducing operational costs contribute to maintaining a competitive edge in pricing. Monitoring and adapting to market conditions are essential components of a successful aquaculture business, ensuring that farmers can respond effectively to changes in demand and market dynamics,” INVE Aquaculture explained.

Feeds

Tailored nutrition plans, protocols and specialized feeds for different stages of growth and species have been in demand in 2023. “Operational profitability can be unlocked by customized feeding protocols that optimize growth and health,” INVE Aquaculture said.

“Hatcheries often seek specialized feeds tailored to different species and developmental stages. Nutritional expertise and innovative feed formulations designed to optimize growth and health are highly sought after, and standardization of the first feeding can be the next step for several hatcheries,” said Jan Giebichenstein, head of customer service at CFEED.

“Microalgae and their efficient production systems are gaining traction as a superior, environmentally friendly marine ingredient. This high-quality alga is pivotal for hatcheries' daily operations. However, challenges persist in implementing and scaling these systems within ongoing hatchery operations,” Giebichenstein said.

Some hatcheries are moving to low-cost feeds but others have been looking for advanced live food technologies. “The hatchery industry has been increasingly adopting advanced live food technologies, including automation of harvest, artificial intelligence, and data analytics, to improve the production of live food. Hatcheries are looking for AI-powered tools and Artemia technologies to improve live food quality, simplify harvesting, maximize output, reduce risks, and ensure sustainability,” INVE Aquaculture said.

Genetics

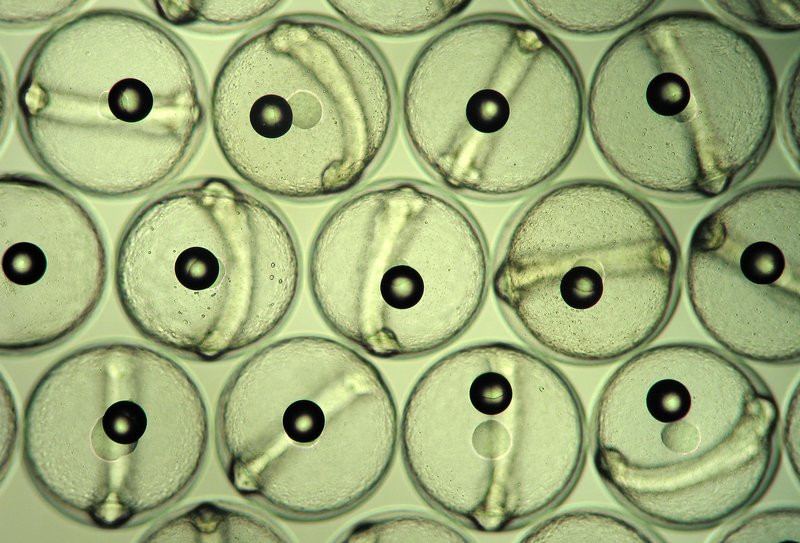

There is a growing demand for specialized genetic selection and breeding services to enhance the performance and characteristics of the fry, larvae of aquaculture species.

“The only way to overcome the current market conditions is by increasing efficiency: using fewer broodstock to produce more larvae and enhancing larvae survival at higher densities. This is being addressed in the current breeding programs by selecting for the most economically important traits,” said Marcos De Donato, breeding scientist at the Center for Aquaculture Technologies (CAT).

“The low market prices must be addressed by production systems featuring lower production costs. One of the main costs in aquaculture systems is feed, which accounts for 50-80% of total costs depending on the production system (FAO). Having animals that grow more efficiently while maintaining current survival rates will help reduce feed costs. Additionally, this will decrease the number of cycles per year, lowering costs associated with land use and other services, such as electricity,” said Carlos Pulgarin, breeding scientist at the Center for Aquaculture Technologies.

There has also been an increased interest from aquaculture companies in genome editing. “This is an exciting technology, and some really interesting research is underway in this area by our company and other research teams. 2024 holds the opportunity to begin commercializing this technology, and this will have to be done inside the commercial hatchery,” said John Buchanan, CEO of the Center for Aquaculture Technologies.

Credits: Shutterstock

Disease

Disease outbreaks have been a consistent challenge for hatchery farmers, impacting the production of all fish species and affecting the main commercial fish species in different ways.

Tilapia

2023 has been a challenging year for the global tilapia industry with new bacterial and viral diseases emerging in several markets and having significant impacts on fish health and production.

“In recent years, there has been an increase in mortality rates, ranging from 10-50%, primarily due to Streptococcus agalactiae. It is necessary to intensify mitigation measures, including the need for field tools to alleviate mortalities and production losses caused by this bacteria. Strategies such as vaccination and the establishment of genetic lines resistant to the disease are crucial. Additionally, strengthening health, and improving monitoring and control systems are necessary to prevent its spread,” said Pulgarin.

“In Brazil, tilapia farmers are investing increasingly in vaccines and there is a growing interest in automation of administration. Several of the major producers have switched from manual injection to semi-automatic vaccination machines with good results. Investing in vaccines makes little sense unless one makes sure that they are properly injected,” said Terje Tingbø, head of commercial development, Emerging Markets, PHARMAQ part of Zoetis.

Vaccines are important tools to control and prevent disease, but they are pieces of a bigger puzzle, and developing and licensing efficacious and safe vaccines takes time. “Factors such as genetics, nutrition, optimization of the environment, stress reduction, and not least diagnostics and biosecurity are also very important contributors to preventing disease. In the salmon industry, proper regulation and area management plans, mandatory screening programs and access to competent fish health services and diagnostic tools have been shown to significantly reduce the spread and impact of diseases. To implement such measures efficiently a close collaboration between farmers, authorities, academia, and technology suppliers is needed,” said Tingbø.

Seabass & seabream

Production costs derived from huge increases in feed, energy and oxygen that occurred in 2022 and also partially in 2023 have pushed hatcheries and pre-growing out units into optimizing the holding time in the facilities. “The drive has been to shorten it as much as possible, but this needs to be done following vaccination programs, which means that vaccination has to be done at a time point that ensures optimal protection at transfer to sea,” said Roberto Guijarro, PHARMAQ Business Unit Lead, South Europe Cluster, Zoetis Spain.

“The trend towards earlier vaccination is pushing down the size at injection to 12 g and as a consequence, we are seeing interest in micro-dose commercial formulations, where the volume of vaccine administered to fish is lower than previous formulations (0.05ml vs. 0.1ml). The smaller dose volumes also improve compatibility when co-injecting with other vaccines, which is another trend that we are seeing in farmers who have to combine different vaccines to access the different antigens that they need to protect their fish,” Guijarro said.

Salmon

In general, there is an increasing concern related to animal welfare and high mortality in the salmon industry. This is multifactorial and complex, where both diseases, handling of the fish due to sea lice treatments, environmental factors and gill health drive the mortality.

“There is a high focus in the industry to solve these problems, and one of the trends we see is a shift towards new production systems such as RAS, offshore farms, closed/semiclosed systems and submersible cages. We also see a shift towards the production of large smolts, where the aim is to shorten the production time in traditional seawater sites. With new production systems, there is a need for monitoring and new tools, to be able to control factors related to fish welfare, but also water quality, etc. There is also a need for non-lethal sampling methods, to reduce the number of animals used in surveillance programs,” said Marie Egenberg, business unit director Salmon Europe and Global Marketing, PHARMAQ part of Zoetis.

There is a continuous development of new vaccines to combat emerging diseases. “To meet the new disease challenges, we see a trend towards the use of combinations of vaccines, making the development of new products and the vaccination process more complex and costly. The changing and geographically diverse disease situation requires more flexible vaccine solutions, said Egenberg.

In Norway, farmers are vaccinating with up to four vaccines simultaneously. “The increased number of vaccines used is due to the development of diseases such as winter ulcers caused by Moritella viscosa, and yersiniosis,” said Lars G. Jørgensen, area sales manager Norway and Nordics, PHARMAQ part of Zoetis. “We have also seen that the infectious salmon anemia (ISA) situation in the south of Norway has led to increased use of basic vaccines containing an ISA component.”

“The increased requirement for vaccines has led to a growing demand for vaccination machines that can deliver multiple vaccines of different formulations and viscosity simultaneously. The higher demand for automized vaccinations is also driven by labor reduction, precision and consistency, versatility, and biosecurity focus,” said Hanne Andersen, sales manager, PHARMAQ Fishteq.

Pangasius

Enteric Septicemia of Catfish (Edwardsiella ictaluri) and Motile Aeromonas Septicemia (Aeromonas hydrophila) are the two most important bacterial diseases affecting the industry and demand for vaccines has increased.

“One of our main focuses while introducing vaccination has been to inject the pangasius as early as possible at the hatcheries and fingerling farms, to ensure optimal immunity upon transfer to the on-growing ponds. This strategy has proven successful, further improving survival rates and reducing the need for antibiotic treatments. Close to 170 million fish were vaccinated by major pangasius producers in 2023 and we are preparing for a significant increase in demand for vaccines, diagnostics, and fish health services in the coming year,” said Tingbø. “We are currently establishing a new state-of-the-art wet lab facility for clinical studies and expanding the capabilities of our diagnostic laboratory in Mekong.”

Climate change

Climate change can affect water temperature, oxygen levels, and overall environmental conditions, influencing the health and growth of aquaculture species. The increase in temperatures can affect aquaculture both positively and negatively, depending on the species being cultivated and the production system.

An example can be seen in seabass and seabream. “Outstandingly high temperatures recorded in the sea since June 2023 in some countries have caused the rising of unusual pathogens such as Lactococcus garvieae in both seabass and seabream, as well as intensifying the clinical impact of Pasteurellosis and Nodavirosis in seabass. However, grow-out performance has been quite good due to these high temperatures in the sea,” Guijarro stated.

In the case of negative effects, the implementation of genetic programs aimed at enhancing resistance to thermal stress, specific diseases, and overall survival or robustness can be some of the actions to be taken. “This is achieved through pedigree selection or genomic selection, for which individuals don't need to be directly exposed to thermal stress or pathogens. Instead, this can be accomplished through challenge tests using samples from cultivated populations, providing an advantage in the context of global warming. Producers can start developing resistant lines now to be better prepared for the increasingly extreme conditions expected from future global warming,” Pulgarin explained.

“One of the main focus of breeding programs now is survival measured under commercial environments, to be able to produce lines adapted to the new environmental conditions. Additionally, higher temperatures create ideal conditions for pathogens to cause outbreaks, making the selection for disease resistance more important than ever. Under these conditions, genomic selection is the strategy that can produce the fastest results and the best return on investment,” said De Donato. “Higher efficiency, sustainability and adaptation to climate change are the most significant challenges that the industry is facing. Implementing advanced technologies is the only way to help the producers cope with these challenges.”

Despite the market challenges, sustainability is becoming an important part of the hatcheries' agenda. “There's an increasing emphasis on sustainable and eco-friendly practices in the aquaculture industries. Companies and hatcheries that offer sustainable solutions are likely to be sought after,” INVE Aquaculture said.

Issues such as water quality, habitat destruction, and the use of wild-caught fish for feed have raised environmental concerns. “Sustainable aquaculture practices involve minimizing environmental impact, adopting responsible feed practices (e.g., alternative protein sources), and adhering to specific certifications such as Aquaculture Stewardship Council (ASC) standards,” INVE Aquaculture said.

The outlook

Despite this challenging 2023, the outlook for 2024 shows promising signs of recovery, although with cautious optimism.

“Major farmed finfish species, including seabream and seabass, are poised for growth. Global Atlantic salmon production is expected to grow by 4.3% and 3.9% in 2024 and 2025, respectively, with Norway leading this surge. Nonetheless, challenges like potential algal blooms due to El Niño conditions could impact production. Tilapia production, particularly in Asia, is on a recovery path, potentially outpacing 2019 volumes with a 5.3% year-on-year growth in 2023,” INVE Aquaculture said. “Market prices remain a top concern for the industry, influenced by ongoing inflation and the pace of seafood demand recovery. Consumers may opt for lower-priced protein sources, affecting market dynamics. The industry, therefore, must navigate these economic uncertainties while gearing up for a potential upswing in production in 2024.”

“Broadly, the demand for seafood continues to grow and hatcheries of course play an important role in addressing this demand. For most species, growth is expected. Opportunities are there for innovation to improve efficiency and productivity, meet the increasing demand, and mitigate increasing costs. We see 2024 as a year of innovation as research in genetics, husbandry, and data technologies will see increasing commercialization at the hatchery level,” Buchanan stated.

“With the market trends, including shifts in consumer preferences, demand for sustainable seafood, and regulatory changes, we are looking into an exciting year for marine aquaculture. Adding ongoing research and technology advancements into alternative and sustainable feed sources, potentially affecting the cost structure and environmental impact of marine aquaculture, 2024 can be a prosperous year for marine aquaculture,” Giebichenstein said.

“Overall, the sector should be more open to new technologies and approaches as more and more people realize that progress in technical and managerial aspects is inevitable,” Coli concluded.