Norwegian cod aquaculture company, Norcod, recently finalized its first full production cycle and is moving ahead to scale up the production of this species. We spoke with Christian Riber, CEO of Norcod, to get more insights into the hatchery demands and developments to reach this milestone.

Norcod was founded by Sirena Group in 2018. “I worked at Sirena at the time where we were selling a lot of wild cod and then we tested farmed cod. We quickly saw that if we could get this quality of fresh cod into the market 12 months a year, there would be a huge market,” Riber said.

Cod farming had its heyday in Norway in the early 2000s but the lack of biological know-how and financial crisis led to the end of production. But today’s cod is completely different from the one in the 2000s. “It is completely different biology that we are working with today compared to 2000s. They started from wild cod in 2002 and today we are working with generation 7. Nowadays, it is a calm and domesticated fish that is very robust and has great growth,” Riber said. Nofima’s national breeding program greatly contributed to reaching the commercial scale. “There is no doubt that thanks to Havlandet Marine Yngel and Nofima breeding programs we can have cod farming today.”

Hatchery facilities and developments

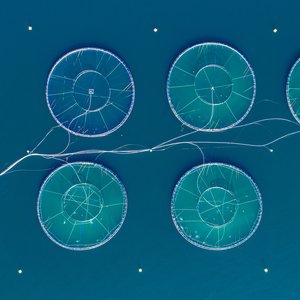

Norcod and cod fry producer Havlandet Marin Yngel partnered in a 50-50 joint venture, Havlandet Norcod AS, to build a new hatchery in Florø, Norway, that is expected to be ready in autumn 2022. “We have invested in membrane filtering to get the optimal biosecurity on all water going into the facility. This is a big investment and a technically demanding facility with a very high innovation level,” Riber mentioned.

When it comes to broodstock management and reliable spawns, Riber said there is no real challenge. “Through 20 years, Havlandet has secured so much knowledge about the genetics, breeding and the required environment that gives us access to high-quality broodstock and eggs year-round.” The company is currently running a breeding program. Havlandet has developed an SNP chip with over 61,000 markers and is now working on improving several traits, mainly focusing on growth, cost and fish welfare.

Despite room for improvement, the company has reached a very stable larval production with high survival and limited deformities rates. Once the fish is around 100 g on land, it is transferred to sea facilities. Havlandet Norcod is also partnering with feed producers, such as Aller Aqua, to develop broodstock, larval and fry feeds.

Future projections

Norcod has four sites and a total maximum allowed biomass of 10,320 tonnes and plans an annual production of 27,500 tonnes of cod by 2025. “We have built the hatchery so we have a minimum capacity of 24 million fry which is equal to 80,000 tonnes of full-size cod but the capacity is probably closer to 100,000 tonnes, so we don’t need another hatchery. We target 27,500 tonnes in 2025 but we are not gonna stop there. There is market potential for several hundreds of thousands of tons of farmed cod of high quality,” Riber stated.

Farmed versus wild cod

When separating farmed cod from wild cod, Riber said that farmed cod needs to be its own category as it has so many other attributes, such as year-round availability, the stable high quality, firm meat and a bit sweeter taste. “Farmed cod is not a substitution for wild cod but an addition so like you see with salmon where you can have both wild salmon, regular farmed salmon and bio salmon side by side. We see the same thing with cod. We also have already separated farmed from wild cod during the season as we had a contract running through the whole season so retailers have already seen the difference and are ready to pay for it,” Riber mentioned.

“We are seeing great biology with big potential, a finished product of very high quality that the market has a huge demand for and a market that is missing so much fish due to quota cuts and the Russian situation (Russia has 40% of the global Atlantic cod quota),” Riber concluded.