Bank of Baroda in partnership with Aquaconnect will provide credit access under the Kisan Credit Card scheme at an annualized rate of as low as 10%. The fish and shrimp farmers can also utlize the advisory services and quality farm inputs from Aquaconnect platform. Under this partnership, Bank of Baroda has extended loan for up to 10 lacs under KCC scheme and fisheries loan. Higher credit limits can also be obtained under Pradhan Mantri Matsya Sampada Yojana (PMMSY) and The Fisheries and Aquaculture Infrastructure Development Fund (FIDF) schemes on case-to-case basis.

The bank requires minimal and easy to access documents under the KCC scheme such as KYC documents, farming license and land records. Farmers can take avail loans for their working capital needs to support their farm operations. The company aims to target Andhra Pradesh, Tamilnadu, Gujarat and Orissa and later extend it to other states of India. The partnership will benefit fish and shrimp farmers across India.

According to Rajamanohar, CEO, Aquaconnect, “due to the lack of formal credit access, Indian fish and shrimp farmers depend heavily on informal lending that pushes them to pay annualized interest as high as 40% to finance their farming operations. We are happy to partner with Bank of Baroda to enable low-interest farm loans for the farmers.”

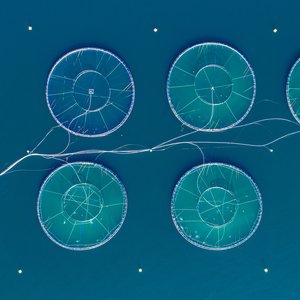

Amit Salunkhe(Dhas) Head BFSI, Aquaconnect, said on the partnership, “Aquaconnect’s AquaCRED platform helps banks manage the entire aquaculture lending portfolio throughout the loan lifecycle. We use cutting edge machine learning algorithms and satellite remote sensing analytics, to provide a near-real time view of the portfolio.”