Low prices and low demand in 2023 have been the main concerns for the shrimp industry. This has directly impacted farm production throughout the year, especially hatcheries.

“Hatchery farmers are consistently challenged by the fluctuating market prices of their aquaculture products. Factors such as supply and demand, global economic conditions, and competition can impact the profitability of hatchery operations,” said Geert Rombaut, PM Artemia and Live Food at INVE Aquaculture.

“Farmers are grappling with a period where market prices are either lower or equal to production costs. This situation underscores the imperative for the hatchery sector to prioritize customer loyalty amidst the current low demand for seeds, driven by farmers adopting a selective stocking approach,” SyAqua commercial team said.

“Many hatcheries are forced to supply their PLs on credit, otherwise, farmers will move to another hatchery that supplies on credit. In Vietnam, the credit among hatcheries has been huge in 2023 and the new Transparent Postlarvae Disease (TPD) has been pushing hatcheries to close down,” said Florian Renault, co-founder of SPF Shrimp Feeds.

“Simultaneously, farmers have been intensifying efforts to maintain costs below shrimp prices, crucial for enduring the prolonged period of low shrimp prices. Hatcheries, recognizing these challenges, are exercising caution in planning the import quantity of broodstock to ensure that maturation costs remain manageable,” SyAqua said.

“The selective stocking strategy involves opting to stock during peak seasons and avoiding the challenging culture period in the monsoon season towards the year's end. Moreover, effective management practices play a pivotal role in minimizing the risk of losses during the early stages of production. This includes meticulous control of water quality, ensuring disease-free environments, and providing high-quality, digestible feeds. These multifaceted strategies underscore the collaborative efforts of both hatcheries and farmers to navigate the complexities of the current shrimp industry,” SyAqua said.

Focusing on efficiency

The most successful hatcheries have focused on improving efficiencies in 2023. “Some managers have resorted to lower-cost/lower-quality inputs, resulting in lower survival and PL quality. The best hatcheries have prioritized efficiency improvement through better management and enhanced survival rates. Profitability is highly sensitive to PL survival, and the focus on efficient use of high-quality feeds, along with tightly managed feeding rates, has improved water quality, growth, and survival. Despite an oversupply of PL, the best hatcheries with robust PL have maintained and expanded their market share,” said Craig L. Browdy, director of research and development at Zeigler.

Farmers, cognizant of the pivotal role reliable seeds play in their operations, are fueling the increased demand for products that contribute to the overall health and success of shrimp cultivation. “In 2023, there has been a significant upswing in the demand for high-value nutrition, effective hatchery probiotics, and superior-quality seeds within the hatchery industry. This surge is driven by farmers' imperative need for dependable seeds crucial to their stocking plans. The emphasis on a robust water treatment system in both hatchery and farm management has also intensified due to the heightened risk of new pathogenic agents spreading between the environment and culturing systems, exemplified by the severe Early Mortality Syndrome (EMS) pandemic,” SyAqua said.

“The two main challenges facing shrimp larvae hatcheries are costs and disease. Their higher energy and feed costs, coinciding with the lower profitability of their customers due to the low price of shrimp, have made profit margins very small (sometimes negative margins) and created great fierce competition among hatcheries. Production in highly impacted environments and rising temperatures have increased the frequency of disease outbreaks, creating losses for the hatcheries and their customers. Both problems are being addressed by selecting reproductive traits (to lower larvae production costs) and early-stage survival (disease resistance or robustness),” said Marcos De Donato, breeding scientist at the Center for Aquaculture Technologies (CAT).

Regional highlights

The move toward increasing efficiencies has not been the same in all shrimp-producing areas. “We have seen consolidation into larger companies in the West and, in some cases, in the East by larger associations of small producers, and in all cases, improved management through technification,” said Browdy.

“In Indonesia, we are seeing significant investment in new hatchery facilities from both the private and government sectors, selling PL to grow-out farms. One clear concern is how to have a unique value proposition for the farmer buying the PL. There are many ways to create UVPs but it all starts with listening to the farmer as to what their biggest challenges are and where to possibly develop PL that solves these problems,” said Melony Sellars, CEO at Genics. “Ecuador has a similar story regarding the development of a UVP for PL sales with much focus now on genetically diverse and healthy PL, as opposed to just genetic diversity.”

“In Vietnam, we hear of significant challenges with new and emerging transparent postlarvae disease which is thought to be caused by bacterial infection. This is of significant concern to the Vietnamese hatchery industry and continues to be a topic of much focus as assays for accurate detection and methods for management are assessed and established,” Sellars said.

Some farmers are adapting their stocking strategies by shifting to monodon species, finding it to be a more straightforward and predictable option with fewer disease issues during the culture period compared to vannamei. “Other farmers are opting for balanced lines and devising plans to harvest larger shrimp at 15-25 counts, which proves to be a profitable approach,” SyAqua said.

“In India, we are seeing a slight shift back towards Penaeus monodon farming. This requires slightly different husbandry skills. However, India is in the fortunate position that many of the experienced industry members still have the knowledge and skills from many years ago for this species, before the rapid shift to L. vannamei occurred,” Sellars said.

Credits: Shutterstock

Feeds

High feed prices, highly sensitive to ingredient costs, are still a major concern for shrimp farmers.

“Insecurity of traditional protein sources has made ingredient cost management more and more challenging. The outlook for 2024 is difficult to predict as many different factors affect the prices of wheat, soy, fishmeal, and other inputs. Much scientific research has gone into alternative sources of key inputs. Success stories continue to emerge, including alternative sources of highly unsaturated fatty acids to replace increasingly high-cost fish oil. Competition between feed producers and robust scientific research will continue to drive improvements in alternative feed formulation strategies. The best-managed farms using the most effective feeds will ultimately be the most profitable in 2024 and beyond,” Browdy said.

“The consolidation process within the shrimp industry will persist, placing additional pressure on feed millers to engage in reformulation efforts to maintain competitive prices, especially amid the ongoing prolonged period of low shrimp prices, which industry leaders predict will extend into 2024,” SyAqua stated. “Looking ahead to 2024, it is likely that feed prices will remain stable unless there is a recovery in fishmeal production. In the event of such a recovery, prices may gradually decrease. However, the ongoing industry challenges and the need for feed millers to navigate the delicate balance of cost-effectiveness and quality are expected to persist.”

In tough economic times, the first idea to reduce production costs is the substitution of products with a higher price such as feeds. In doing so, two important points should be kept in mind.

“All costs should be considered when production cost is being evaluated. This includes costs linked to not only product inputs but also the cost of nauplii, energy, labor, transport costs, depreciation, and fixed costs. Feed with a higher price can easily pay off and even result in higher operational profitability because the increased harvest output (number of harvested individuals) will have a cost-reducing effect on all the other cost contributors (evaluated as the cost per 1,000 postlarvae produced). Ultimately this will lead to a higher EBITA of hatchery operations. Likewise, improved growth allows for shorter culture cycles, not only reducing the number of culture days and costs that come with these but also limiting the risk of mortality events during these last days of culture,” Eva Werbroeck, PM shrimp formulated diet at INVE Aquaculture, stated.

“Substitution of feeds, or any other product, should come with a thorough evaluation of postlarval quality. This requires very good follow-up because postlarval quality typically comes to expression during the later grow-out production stages. Product and protocol changes should not go overnight because wrong decisions during hatchery culture cannot be undone, and the resulting reputational damage must be managed,” Werbrouck said.

Not only the high prices of manufactured feeds are a concern, but Artemia prices as well, according to Eric De Muylder, director of CreveTec, as well as the good quality of algae produced on-site.

“A holistic approach integrating genetics and nutrition, aiming not only to enhance survivability but, most crucially, to optimize the outcome, is advised. This translates into the best returns on investment, underscoring the efficacy of using high-quality feed,” SyAqua said.

Diseases

A major concern for the shrimp hatchery segment in 2023 has been the continuing emergence of highly pathogenic Vibrios affecting both hatcheries and newly stocked PL in nurseries and farms. “Scientific literature suggests that the trend toward epidemic mortalities during early PL stages may be traced to pathogenic Vibrio species producing different toxins, resulting in high mortalities. In the West, Vibrios producing PirA and PirB toxins have been implicated, while in Asia, Vibrio parahaemolyticus producing a different toxin has been associated with larval mortalities, “ Browdy said.

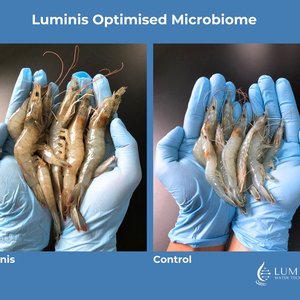

Vibrio-associated mortality has always been a major concern for hatchery managers. “Despite known issues with diminishing effectiveness over time, the use of antibiotics to control pathogens continues in many hatcheries. Antibiotics and water exchange can reduce pathogenic Vibrios for a time, but they open space for the fastest-reproducing microbes, often the very species the manager is trying to control. The best-managed hatcheries focus on hygiene and the use of carefully cultured, high-quality live feeds screened to ensure low Vibrio counts for controlling pathogen introduction. These efforts are coupled with the effective use of probiotics and feed management to assure good water quality and a stable, diverse microbial community. New technologies incorporating effective probiotics into microencapsulated Artemia replacement feeds have been shown to improve overall survival rates,” Browdy said.

“In many hatcheries, ongoing efforts are made to employ preventive and prophylactic measures for pathogen management. Strategies like the use of antimicrobials and water exchange have been implemented to mitigate pathogenic Vibrios for a specific duration. However, it is crucial to be mindful that such practices may inadvertently foster an environment conducive to the proliferation of rapidly reproducing microbes, including the very species the manager is seeking to regulate,” Rombaut said.

“The development of protocols using selected strains of safe bacteria to compete with potential pathogens has significantly improved rearing conditions. Zero-water exchange and the use of probiotics has been highly effective not only before and during stocking but also throughout production and harvest,” said Olivier Decamp, R&D director & business development director at INVE Aquaculture.

Advanced biosecurity solutions are a good alternative and in 2023, hatcheries saw a surge in their demand. “This trend stems from the critical need to combat threats like Vibrio infections. Hatcheries now prioritize robust biosecurity measures across all production phases, from broodstock to grow-out stages. Key products include Specific Pathogen Free (SPF) and Specific Pathogen Resistant (SPR) shrimp stocks, innovative feed solutions, ozone and UV water treatment systems, ultra-filtration systems, HEPA air filters, and probiotics for microbial balance with focus on pathogen control, maintaining water quality and bioremediation. These solutions are vital in ensuring the health, productivity, and sustainability of aquaculture operations,” said Andrew Shinn, global technical expert at INVE Aquaculture.

Hatcheries have been prioritizing robust biosecurity measures across all production phases, from broodstock to grow-out stages. “Whether you are spawning SPF Broodstock from the USA, Thailand, Indonesia or elsewhere, broodstock from farm ponds, or those still taken from the wild, there is a global trend for increased attention to detail on ensuring the animals producing the next generation are healthy and where possible free from pathogens. The message is clear that pathogens pass from parent to offspring as one mechanism of transmission, and our industry is taking action at a global scale to improve PL health and quality,” said Melony Sellars, CEO of Genics.

For those using live feeds for broodstock, the trend is to source them from reliable suppliers. “We experience a high demand for SPF polychaetes to feed broodstock (vannamei and monodon), especially in India. Most of the broodstock used in the country are from the USA and SPF-certified. Hatchery owners and technicians now acknowledge that one of the first sources of contamination (EHP and, more recently, Translucent Post-larva Disease) comes from live feeds (wild-caught and locally farmed polychaetes),” said Renault.

“In terms of breeding, throughout 2023, we have seen an unwavering strong demand for genetic selection of animals that grow well but also demonstrate a level of tolerance to challenging environmental and pathogen-loading conditions. This desire for animals that are tolerant but still grow well has driven increased demand for high-quality phenotyping and environmental comparison studies of different genetic lines to link to genotypes,” Sellars said.

“We also see an overuse of point-of-care testing of postlarvae before stocking into grow-out systems with kits and methods that are not fit for purpose. What that means is that a kit or method might be designed for detecting pathogens in clinically sick animals, where infection loads and templates for positive detection are medium to high. However, with misleading marketing such kits are also being used for early pathogen detection before clinical signs of disease (PL clearance testing, for example) but they are not suited for this purpose and are not able to detect very low levels of pathogens in the PL. The end result is potentially misleading false negative PL test data and a farmer may be at risk of stocking animals that indeed carry commercially devastating pathogens. Education of industry on fitness for the purpose of different testing methods is one way forward to help alleviate this challenge for our global shrimp farming industry,” Sellars said.

Credits: Lucía Barreiro

The rise in temperatures

Climate change and increased temperature may affect shrimp farms, especially in certain areas such as India. “Some hatcheries in India were significantly affected during the hot summer due to higher-than-normal temperatures, impacting maturation output. This resulted in challenges such as reduced mating, lower nauplii production, and occasionally, diminished nauplii quality,” SyAqua reported. “In the production of post-larvae (PL), the elevated temperatures posed difficulties in management, accelerating larval activities and leading to increased feed consumption and excretion. The organic matter generated from these activities facilitated faster Vibrio replication, negatively affecting seed health and survivability. Hatcheries with temperature control facilities were better equipped to address these challenges.”

“Conversely, at the farm level, the impact was less severe, attributed to the substantial water volume in ponds that helped stabilize temperatures. Despite these challenges, hot seasons continue to be conducive for vannamei shrimp culture. It's worth noting that the indirect effect of high temperatures is the concurrently elevated salinity, which can lead to growth retardation and imbalances in water quality. These impacts highlight the need for comprehensive management strategies to address the complex interplay of environmental factors in shrimp farming,” SyAqua said.

The outlook

Would the current shrimp market challenges improve in 2024? “Swings in supply and demand have always been cyclical. Elasticity in production levels, consumption rates, and associated variation in prices are to be expected. The most efficient producers will maintain the best profitability in any market,” Browdy stated.

“Promotion of local consumption instead of focussing on export only should be encouraged. It is not the low demand but higher production that lowers the selling price of shrimp. The other issue is quality. Currently, there is little control over quality as shrimp is more and more considered a commodity,” said De Muylder.

“Within every crisis lies an opportunity. Although 2024 may pose continued challenges for all stakeholders in the shrimp industry, it presents an occasion for farmers to reassess their stocking strategies and genetic selections. SyAqua anticipates a shift in mindset among farmers who, previously prioritized lucrative returns over cost management due to high shrimp prices, will now lean towards extreme cost consciousness to sustain their businesses. This shift implies a potential paradigm change towards a more scientific shrimp culture strategy. Rather than solely focusing on metrics like Average Daily Growth (ADG), there will likely be a greater emphasis on reliability and consistency of yield. SyAqua believes that increasing survival rates and decreasing Feed Conversion Ratios (FCR) will be key components in helping farmers reduce production costs, presenting a significant opportunity for improvement within the industry,” SyAqua said.

“The best-managed farms will continue to reduce costs through better control of inputs. The most efficient producers will continue to reduce FCRs through better population management, coupled with the use of auto-feeders and high-quality feeds. Efficient feeding is the key to managing the production environment, controlling costs, and improving both environmental and financial sustainability,” Browdy said.

“With many shrimp operations around the world either partially dry or considering a dry spell and not stocking due to current shrimp prices, we have an extremely widespread self-imposed sanitary process underway. In theory, this will be followed by extremely good shrimp crops when re-stocking does occur with reduced pathogens and heightened production performance. Is there a silver lining to these challenging times?” Sellars concluded.