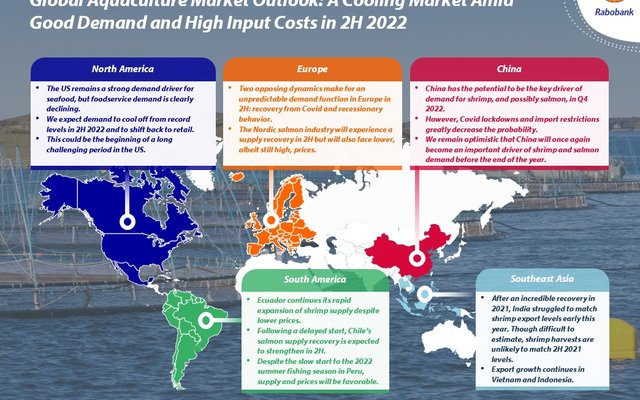

Weaker seafood demand is expected in 2H 2022 compared to both 2H 2021 and 1H 2022. With softening demand, price corrections, and persistently high production costs, salmon and shrimp farmer profits are likely to decline from recent highs, and farmers may face a challenging 2H. In contrast, fishmeal prices are likely to be supported by the high prices of alternatives.

A cooling market in 2H 2022

According to Rabobank’s latest report on aquaculture, recessionary dynamics have already started in both the EU and the US amid their COVID-19 recoveries. As such, the food service demand for seafood is expected to cool in both regions, which means another switch back to retail. However, China presents an unpredictable factor for 2H 2022. Potentially, there is a considerable upside for both shrimp and salmon, especially in Q4 2022, as long as COVID-19-related lockdowns and import restrictions are not reintroduced.

“The US remains a strong demand driver for seafood, but food service demand is clearly declining. This could be the beginning of a long challenging period in the US. But China has the potential to be the key driver of demand for shrimp, and possibly salmon, in Q4 2022,” explained Gorjan Nikolik, senior global specialist, Seafood at Rabobank. “Though we remain optimistic that China will once again become an important driver of shrimp and salmon demand before the end of the year, COVID-19 lockdowns and import restrictions greatly decrease the probability.”

Elevated costs to persist

Feed, freight, and energy costs are expected to remain high or even increase in 2H 2022. For salmon farmers, a large part of 2021 and 1H 2022 was marked by record profitability, driven entirely by high price levels. Prices are expected to partly normalize but remain high in 2H. However, due to the long production cycle, high feed costs have yet to be fully incorporated into the cost function. These dynamics combine to reduce farmer profitability in 2H, but the industry is still expected to generate healthy positive margins.

In contrast, if shrimp supply continues to expand as it did in 1H or if demand further declines due to recessionary consumer behavior, we may see prices below breakeven for farmers. In some cases, this has already occurred. “We remain optimistic about the long-term prospects of the shrimp industry but expect a challenging period in the short term,” noted Nikolik.

Meanwhile, the fishmeal supply remains relatively stable. However, the record-high prices of vegetable substitutes make marine ingredients relatively competitive in feed formulas, supporting demand and prices.