In recent years, the Black Sea region has seen a boom in aquaculture and the trade of seafood, but conflict may hamper this growth in Ukraine and threatens to disrupt seafood trade and supply chains in the region, said the General Fisheries Commission for the Mediterranean (GFCM) of the Food and Agriculture Organization of the United Nations (FAO).

Aquaculture production in the Black Sea region has been growing steadily in recent years, from over 500,000 tonnes of farmed seafood (mostly salmonoids, carp and European seabass) in 2017 to over 700,000 tonnes in 2019, found a GFCM regional study. Aquaculture market in the Black Sea: country profiles is the most authoritative study on aquaculture in the region and on farmed seafood production and trade trends in the six Black Sea countries between 2015 and 2019.

“Aquaculture has been growing in the Black Sea region, helping to boost food security and providing jobs and incomes for many vulnerable rural communities. But the sector is fragile and susceptible to crises especially as small and medium farmers represent the largest share of farmed seafood producers in the region. The current conflict between Ukraine and the Russian Federation is affecting supply chains and prices with farmers in the region struggling to buy fish feeds or feed ingredients and fingerlings to keep their farms running. Trade in farmed seafood will also face challenges,” said Houssam Hamza, GFCM Aquaculture Officer and lead author of the study.

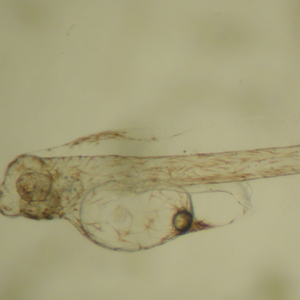

On average, Ukraine produces about 20,000 tonnes of farmed fish per year. There are over 4,000 registered fish farms in the country, the majority being small-scale farms of less than 30 tonnes annual production in artisanal ponds, rearing a range of species – from mainly carp to catfish, pike and trout.

While about 80-90% of the seafood consumed in Ukraine is imported, Ukraine’s seafood exports (farmed, caught, and imported then processed and exported seafood) have been on the rise from about 5,000 tonnes in 2015, worth about USD 20 million, to 11,800 tonnes in 2019, worth over USD 46 million.

In 2019, major destinations for seafood exports from Ukraine included countries in the European Union, Moldova, Belarus, Uzbekistan, Israel, Taiwan and Turkey among others.

When it comes to trade, Russia is by far the largest exporter of seafood (farmed and caught) in the region, with exports of nearly 1.8 million tonnes in 2019, valued at over USD 4.6 billion.

Elsewhere, in Georgia, fisheries and aquaculture only supply 10-15% of the country’s seafood consumption, leaving the country reliant on imports.

In Bulgaria, despite accounting for only 4% of registered aquaculture farms, mariculture, species such as mussels farmed in marine waters, has grown to represent 30% of the total aquaculture production.

In Romania, aquaculture supplies over 11% of seafood consumption, with several fish farms expanding to include services such as ecological tourism and recreational fishing, increasing farmers’ streams of revenue.

In Turkey, the production of aquaculture has increased by more than 50% between 2015 and 2019.

Over recent years, aquaculture has become an increasingly important part of the Black Sea economy. It supplies nutritious food, boosts the local economy, and provides jobs to coastal and rural communities. Both freshwater aquaculture and mariculture are practiced, though, in most countries in the region, mariculture remains underdeveloped.

The Aquaculture market in the Black Sea: country profiles report has been prepared in collaboration with EUROFISH and with the support of the European Union.

Download the report below.

recent-boom-in-aquaculture-under-threat-in-the-black-sea-region